About Us

We are a Swiss-based business platform for Artificial Intelligence (“AI”) in asset management. We aspire to be the global thought leader on AI applications in investment management.

Our Science Advisory Board consists of a select group of experts who are specialized in the intersection of Machine Learning (“ML”) and investment management. These experts contribute academic materials as well as practical use-cases for our events. In partnership with the World Economic Forum (WEF), frontiers in Artificial Intelligence and NVIDIA, new global webinar series on Artificial Intelligence, Explainability and Trustworthiness in Financial Services have recently been launched.

Together with our Science Advisory Board members we strive to cover the entire value chain of AI in asset management, i.e. we not only present the academic findings of this scientific revolution but we also provide concrete advice with regard to the best implementation of AI-powered algorithms to the usage of the appropriate software solution and hardware architecture.

We are sponsored by a group of Swiss-based family offices and foundations, which consider making substantial investments in the best AI-powered investment strategies and technologies. This is in line with the European Union’s coordinated plan to invest almost 20% of its total budget (EUR 150bn) in order to reinforce the European excellence in trustworthy AI.

Our Purpose

It is our purpose to build a bridge between various stakeholders and themes.

We analyse the latest stage of research with regard to AI applications in finance and compare its relevance with real-life implementation of practitioners. We map the scientific findings with the actual performance and check on feasibility as well as practicability of the proposed approaches. By defining a taxonomy for various AI approaches, we also strive to describe the expert language in a commonly understandable form.

We possess a thorough understanding of the traditional stochastic and mathematical approaches to asset pricing and compare these tools with the modern methods of machine learning & big data. We identify overlaps and filter out the distinguishing elements of these two approaches. We are therefore capable of articulating the true added-value of the new technologies.

Throughout our career we have engaged with professional investors from pension funds over private banks to family offices for decades and we thereby understand their exact requirements. We select only those AI software solutions and investment strategies which are able to live up to these highest expectations. Based on an identified fit, we facilitate the interaction between professional investors and the best-in-class solutions.

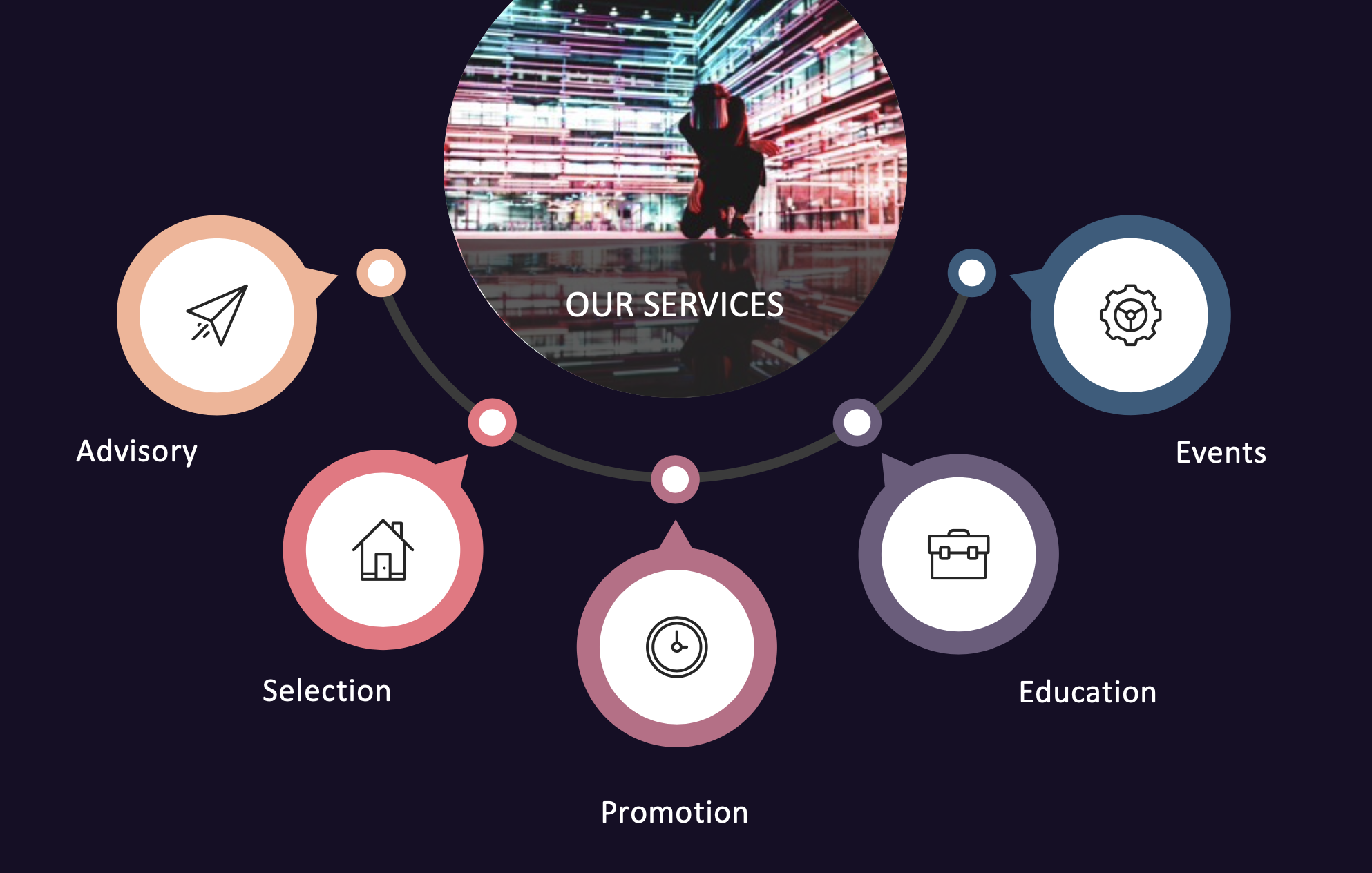

Our Services

We advise institutional investors such as pension funds, insurers, private banks and family offices on AI in asset management.

Our research screens and identifies the best performing software solutions and investment strategies which possess cutting-edge machine learning technologies.

We promote the best-in-class software solutions and investment managers on an exclusive basis to our professional investor base.

We provide educational services at various universities, business schools and financial institutions on machine learning in finance.

Our regular conferences and webinars touch upon the latest topics and shed light on specific sub-themes of AI in asset management.

Pascal Imhof

CEO & Co-Founder

Pascal Imhof is the intellectual architect of Codemacher and responsible for its strategy implementation. Like an eagle with its long-range eyesight from high above Pascal wholeheartedly comprehends the vision 2030 and is intrigued by the complexity and beauty of brain-like deep neural networks.

He started off his career in 2004 as a research analyst and programming expert for quantitative strategies at Man Investments. After Man Investments he gathered extensive asset management industry expertise in various senior business development roles at Goldman Sachs, Lombard Odier and eventually Deutsche Bank.

At Deutsche Bank he represented the asset management division at the DB Suisse Executive Committee, led the client coverage of the Swiss business and was responsible for the coordination of international Private Banks coverage EMEA and APAC. Since 2018 he has been on the advisory board of numerous Swiss family offices and foundations supervising the investment decisions of the CIO office.

He holds a Master in Quantitative Economics and Finance from the University of St. Gallen as well as a Master in International Management from CEMS. Pascal has been an annual guest lecturer at the HSG MBA Finance full time program.

Pascal served the Intelligence Corps of the Swiss Army as a decoder. He loves to create inspiring movies himself. His favourite movies are Shawshank’s redemption, Inception, “Seul contre tous”, The Truman Show and the Matrix. After all, what he loves most, is spending time with his son Nikolay.

Marius Würgler

Co-Founder & Head Business Development

Marius Würgler co-founded Codemacher AG with Pascal Imhof and leads the business development and market coverage strategy. With 24 years of Asset Management experience he has gone through different cycles, crises and trends in the financial industry and he is deeply convinced that applying AI technology in Asset Management will become standard in the future.

After graduating with a Master of Business Administration from University of Bern he started off his career in 1998 as a junior Portfolio Manager at Credit Suisse Asset Management in Zürich and New York where he gathered extensive experience in managing multi asset and emerging market debt portfolios. He afterwards moved into client facing roles where he headed the middle east sales team for Credit Suisse Asset Management and in 2005 moved on to Goldman Sachs Asset Management to build up the Swiss business. In his capacity as Country Head and Managing Director he was responsible for building up the teams in Zürich and Geneva and the full market coverage of all client segments.

In 2011 he took over the lead of the European Sales Team at Lombard Odier Investment Management where he was a member of the Executive Board, responsible for various teams in Switzerland and Europe. After a three year long family adventure in the Caribbean he took over the responsibility as CEO of Amundi Switzerland and beginning 2019 he became Global Head Sales & Marketing at Swiss Life Asset Managers where he was a member of the Executive Board.

Marius is a passionate kitesurfer and snowboarder and if he is not following the financial markets you might find him on the slopes or on the water, preferably with his three kids and his wife.

Jochen Papenbrock

Science Board

Jochen has spent the last 15 years in various roles on the topic of AI in Financial Services, as a thought leader, implementer, researcher and ecosystem shaper. He is a financial data scientist and received his degree and PhD from the Karlsruhe Institute of Technology (KIT).

As a consultant, entrepreneur and researcher he worked with well-known asset managers, banks, insurance companies and central banks. Today, he is a manager at NVIDIA and works with partners, communities, and developers in financial services in Europe and also in some global teams.

Jochen is also a project leader in GAIA-X, the EU cloud project, and he is an executive board member of the EU horizon 2020 project “FIN-TECH”. In addition, he is co-leading the Artificial Intelligence Roundtable at the Frankfurt Institute for Risk Management and Regulation (FIRM).

In partnership with the World Economic Forum (WEF), frontiers in Artificial Intelligence, NVIDIA and the World Alliance of International Financial Centers (WAIFC) Jochen has designed a new global webinar series on Artificial Intelligence, Explainability and Trustworthiness in Financial Services.

One of his focus areas is AI in investment management including AI-generated synthetic market data and Explainable AI as developed in collaboration with the Munich Re Markets team.

Jochen is a specialty chief co-editor at Frontiers ‘AI in Finance’. He has published on AI and quantitative finance in the Journal of Financial Data Science, the Journal of Investment Strategies, the Journal of Financial Markets and Portfolio Management, the Journal of Quantitative Finance and Economics as well as the Journal of Network Theory in Finance.

E-mail: jpapenbrock@nvidia.com

Dr. Arnaud de Servigny

Science Board

Arnaud has been an adjunct professor at Imperial College, London since 2005. He is teaching Machine Learning applied to Finance. He is the author of five financial books related to portfolio management including Measuring and Managing Credit Risk and Behavioural Investment Management and many articles.

Arnaud has been in the Asset Management industry over the past 25 years with senior and global roles in large organizations. In 2014 he set-up Bramham Gardens (www.bramham-gardens.com), a Paris based research lab, whose area of focus is Machine Learning applied to the dynamics of financial prices in scarce and parsimonious data environments. In other words, while a majority of people focus on investments, BG screens the markets to grasp the dynamics of Investor attitudes. BG builds indices for S&P’s and other Index providers.

Alongside BG, Arnaud set-up Queens Field, a French based company applying Artificial Intelligence to Multi-Asset investment strategies to help delivering forward-looking measures of risk to risk-minded Investors looking for a smooth investment journey. Before setting-up BG and Queens Field, Arnaud joined Deutsche Bank where he became the global CIO for DB Wealth Management (€125bn) and the Head of Multi-Asset at DWS. Arnaud was a member of the Executive Committee.

At Barclays Wealth, London, that Arnaud joined in 2006, he was head of research and investment strategy & Asset Allocation. He created the Barclays investment philosophy for individuals. Before joining Barclays Wealth, Arnaud held several senior positions at Standard and Poor’s, which he joined in 2001 from BNPP Group Risk Department. At S&P’s he was an MD and the global Head of Quantitative Analytics. Since 2018 Arnaud has been a non-executive Board Member of Impax Asset Management Group PLC, a 20 year+ specialist investor focused on a more sustainable economy. Since 2016 he also sits on the Board of BNP Paribas Asset Management France as a non-executive Director.

A French national and a father of 4, Arnaud holds a PhD in Financial Economics from the Sorbonne, a MSc in Quantitative Finance from Dauphine and MSc in Engineering from Ecole Nationale des Ponts & Chaussées.

E-mail: a.deservigny@queensfield.net

Prof. Dr. Peter Schwendner

Science Board

Peter Schwendner is a Professor and head of the Institute of Wealth & Asset Management at Zurich University of Applied Sciences, School of Management and Law, Switzerland. His interests are financial markets, asset management and machine learning applications.

After completing a doctorate in physics in 1998 for his research at Max Planck Institute in Goettingen, he collected 15 years of work experience in the financial industry as an MD and head of quantitative research at Sal. Oppenheim and as a partner at Fortinbras Asset Management. He holds the CFA charter and FRM certification.

Currently, he is working on transparent quantitative strategies and evidence-based sustainable investing in joint projects with industry and academic partners.

Peter is an associate editor at Digital Finance and Frontiers in Artificial Intelligence in Finance. Within the European COST Action «Fintech and AI in Finance», he leads the working group «Transparency into Investment Product Performance for Clients».

E-mail: scwp@zhaw.ch

Dr. Pascal Gisclon

Science Board

Pascal Gisclon holds a Master’s degree in Quantitative Economics and Finance, a Master’s degree in International Management (CEMS-MIM) as well as a PhD in Quantitative Finance from the University of St. Gallen. During his PhD, he worked on machine learning methods in the context of systematic dynamic trading strategies, using programming languages such as Python and C++.

He started his career as a quantitative analyst at Swiss Capital Alternative Investments. He later held several management roles at private and retail banks (Wegelin, Notenstein La Roche, Raiffeisen, St. Galler Kantonalbank) and was a member of investment committees. In these roles, he dealt with financial market research, tactical and strategic asset allocation, quantitative investment strategies, quantitative investment and advisory processes, product management and product innovation. Moreover, he was a managing partner and head of business development Switzerland at a fintech company active in the field of holistic wealth planning and optimization using quantitative methods.

He has been a lecturer in banking, financial mathematics and statistics for more than twenty years.

Marina Viergutz

Investor Board

Marina is a Managing Director at Sharenett, a digital platform for Alternative Investments with a global membership base of 450+ family offices. She is responsible for managing International relationships with family offices with a focus on Europe. In addition, Marina heads up business development efforts at Aedifex Ventures, a US based VC firm, and works as an operating partner in several of their portfolio companies, including Sharenett.

Prior to joining Aedifex, Marina had an extensive international career with leading financial institutions, such as JPMorgan and Credit Suisse and had the opportunity to work in the US, Europe and Asia. She started her career at a boutique investment bank in Chicago nearly 20 years ago. Her skill set includes client advisory, portfolio management, investment analysis and driving strategic initiatives.

Marina holds a Bachelor of Science from DePaul University in Chicago, with a concentration in Accounting and Finance as well as a Master of Business Administration from the University of St. Gallen, Switzerland. She is also a CFA and CAIA charterholder.

Marina brings the client perspective to our Advisory Board. Throughout her career, she has worked with family offices and high net worth individuals globally and represents the voice of these clients. Her clients consider making substantial investments in the best AI-powered investment strategies and intend to acquire VC equity stakes in firms with cutting-edge AI technology.